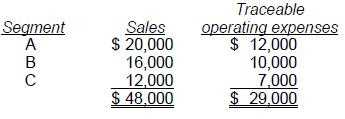

Taft Corp. discloses supplemental industry segment information. The following information is available for 1992:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200

General corporate expenses 4,800

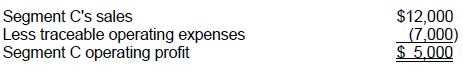

Segment C's 1992 operating profit was:

Answer(s): A

Explanation:

Choice "a" is correct. $5,000 operating profit for Segment C. Rule: Operating profit by segments is based on the measure of profit reported to the "Chief Operating Decision Maker."

Interest expense, income taxes, and general corporate expenses are not allocated to the divisions solely for the purposes of segment disclosures; they may be allocated if that is how the segments report to the "Chief Operating Decision Maker."