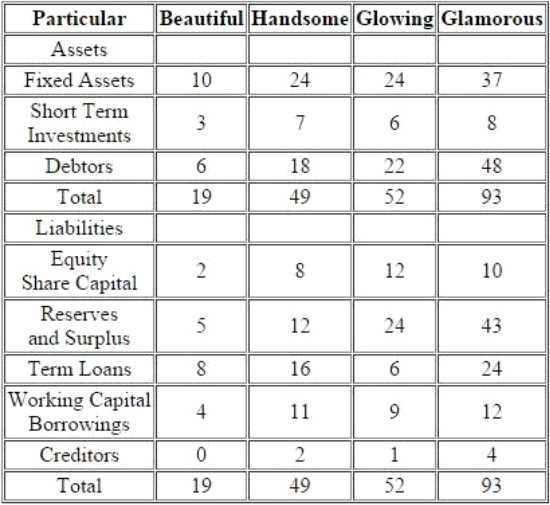

"Following four entities operate in the Indian IT and BPO space. They all are into same segment of providing off-shore analytical services. They all operate on the labour cost-arbitrage in India and the countries of their clients. Following information pertains for the year ended March 31, 2013.

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have given following predictions about the IT Industry:

A) It is expected that INR will appreciate sharply against other USD. B) Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more sharply than Inflation and general wage rise in country.C) US Congress will be passing a bill which restricts the outsourcing to third world countries like India.

While analyzing the four entities, you come across following findings related to Glowing:

Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr. Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr. Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr. Bhutta went on to exit this business as well by selling stake to other promoter(s). There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court."

Based on your findings in the case of Glowing, how will you handle the same as a credit rating analyst:

- Be more cautious and skeptical on any information received from Glowing and give negative marks in management risk and use it as an overriding factor to lower the credit ratings.

- Any of the three.

- Deny taking up assignment for Glowing.

- One needs to check only the corporate governance aspect of the Glowing and the past same should not have any bearing on Glowing.