Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return. Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips. Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy, Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

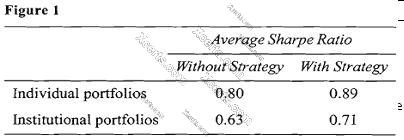

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes. Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

By utilizing the futures and options strategy as suggested by DIS's economists, did Ulster violate any CFA Institute Standards of Professional Conduct?

- Yes.

- No, because she acted in her clients best interest by reducing portfolio risk while increasing portfolio return.

- No, because she treated all clients fairly by applying the strategy to both individual and institutional clients.

Answer(s): A

Explanation:

Ulster has failed to recognize chat while the derivative strategy successfully lowered the volatilities of her clients' portfolios and raised the returns, the strategy may not have been suitable for all portfolios. In particular, the Jones Family Trust investment policy statement strictly forbids the use of derivative instruments, and therefore the derivatives strategy is unsuitable for the account. Ulster should not have used the strategy for the Jones Family Trust account or for any other account that would deem the strategy unsuitable and has thus violated Standard III(C) Suitability. (Study Session 1, LOS 2.a)