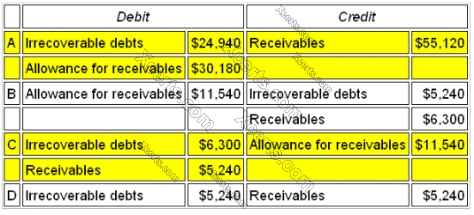

Refer to the Exhibit.

Soffit plc is calculating its irrecoverable debt charge and allowance for receivables for inclusion in its year-end accounts. Based on an aged receivables schedule, it is estimated that an allowance for receivables of $125,820 is required.

In addition, a specific allowance for receivables of $18,640 is also required for two customers who are experiencing cash flow difficulties. There are also two customers who have gone into receivership while owing the company $6,300. The current allowance for receivables is $156,000.

Which is the correct entry to be made to the accounts to record these transactions?

Reveal Solution Next Question