JL is preparing its cash budget for the next three quarters.

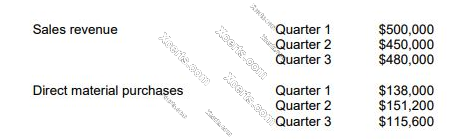

The following data have been extracted from the operational budgets:

Additional information is available as follows:

•JL sells 20% of its goods for cash. Of the remaining sales value, 70% is received within the same quarter as sale and 30% is received in the following quarter. It is estimated that trade receivables will be $125,000 at the beginning of Quarter 1. No bad debts are anticipated.

•50% of payments for direct material purchases are made in the quarter of purchase, with the remaining 50% in the quarter following purchase. It is estimated that the amount owing for direct material purchases will be $60,000 at the beginning of Quarter 1.

•JL pays labour and overhead costs when they are incurred. It has been estimated that labour and overhead costs in total will be $303,600 per quarter. This figure includes depreciation of $19,600.

•JL expects to repay a loan of $100,000 in Quarter 3.

•The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive.

Required:

Prepare a cash budget for each of the THREE quarters.

What will the closing balance of cash flows in quarter THREE be?

- $100 200

- $170 400

- $145 000

- $150 200

- $130 200

- $160 690

- $184 900