DRAG DROP

On 1 January 20X6 AB, a listed entity, had 10,000,000 $1 ordinary shares in issue. On 1 April 20X6 AB issued 3,000,000 $1 ordinary shares at their full market price. AB's profit was reported as $1,100,000 after charging corporate income tax of $500,000.

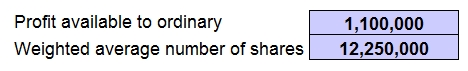

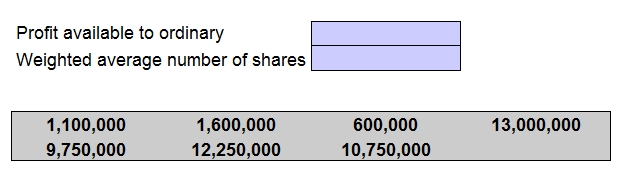

Place the correct values for profit and weighted average number of shares in the boxes below that will be used to calculate AB's earnings per share for the year to 31 December 20X6.

- See Explanation for the Answer.

Answer(s): A

Explanation: