PQ entered into a $300,000 contract on 1 January 20X9 to provide computer hardware to WX with support services for the 3 years from the date of installation.

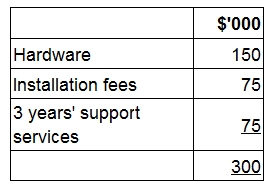

The contract is made up as follows:

The hardware was delivered to WX on 1 January 20X9 and installed immediately. WX paid the full value of the contract on 30 June 20X9.

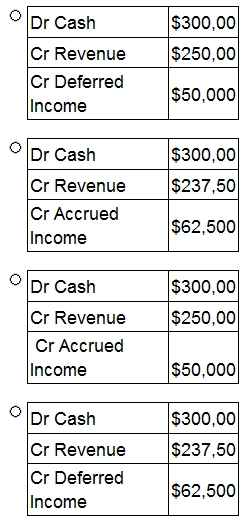

What journal entry records PQ's revenue from this contract for the year ended 31 December 20X9?

- Option A

- Option B

- Option C

- Option D