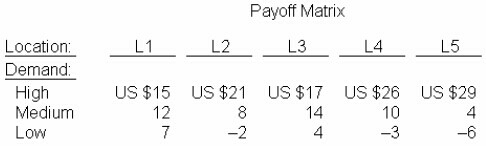

A bank plans to open a branch in one of five locations (labeled L1, L2, L3, L4, L5). Demand for bank services may be high, medium, or low at each of these locations. Profits for each location- demand combination are presented in the payoff matrix.

If, in addition to the estimated profits .management of the bank assesses the probabilities of high, medium, and low demands to be 0.3.0.4, and 0.3, respectively, what is the expected opportunity loss from selecting location L4?

- US$5.50

- US$7.90

- US$7.50

- US$5.00

Answer(s): A

Explanation:

First, the opportunity loss matrix must be prepared