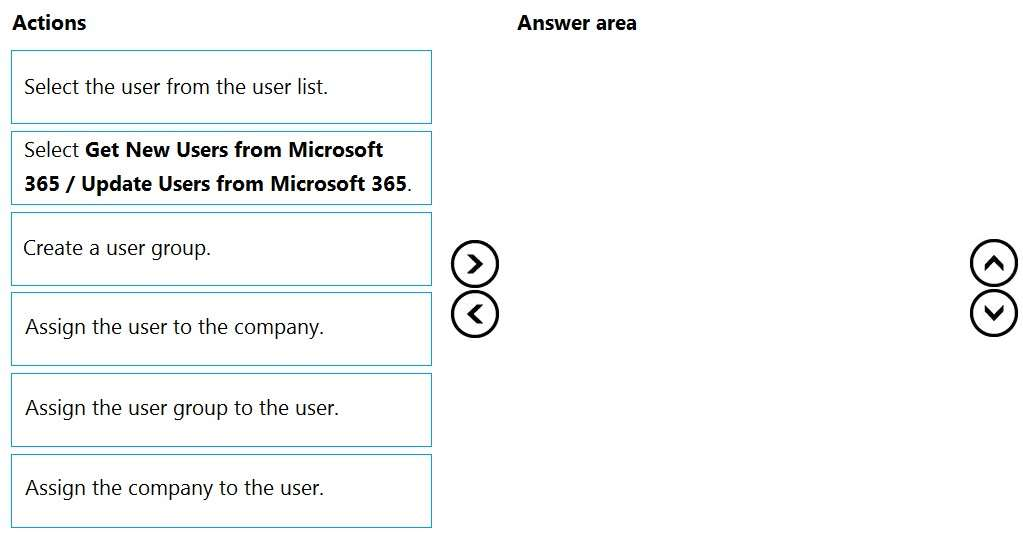

DRAG DROP

A company adds a user to Microsoft 365.

Existing user groups do not have the required permission sets for newly added users.

You need to assign a Dynamics 365 Business Central user group and permissions to the user and the company.

Which five actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

Note: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

Select and Place:

- See Explanation section for answer.

Answer(s): A

Explanation:

Step 1: Select Get New Users from Microsoft 365/ Update Users from Microsoft 365 After you add users or change user information in the Microsoft 365 Admin Center, you can quickly import the user information to Business Central.

Sign in to Business Central using an administrator account.

Choose the Lightbulb that opens the Tell Me feature. icon, enter Users, and then choose the related link.

Choose Update Users from Microsoft 365.

Step 2: Create a user group.

When you create users in Business Central you can assign specific permissions to them through permission sets and organize users in user groups. User groups make it easier to manage permissions for multiple users at the same time.

Step 3: Select the user from the user list.

Step 4: Assign the user group to the user.

In Business Central you can add users to user groups. This makes it easier to assign the same permission sets to multiple users.

Step 5: Assign the company to the user.

We add the user to the Company role.

Note: After you create users, you must assign security roles for them to use. In the Manage User Roles dialog box, select the security role or roles you want for the user or users, and then choose OK.

Reference:

https://docs.microsoft.com/en-us/dynamics365/business-central/ui-how-users-permissions https://business-central.to-increase.com/md/en-US/ui-how-users-permissions