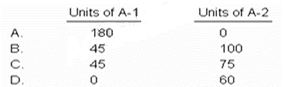

Company J produces two components: A-1 and A-2. The unit throughput contribution margins for A-1 and A-2 are US $150 and US $300, respectively. Each component must proceed through two processes: Operation 1 and Operation 2. The capacity of Operation 1 is 180 machine hours, with A-1 and A-2 requiring 1 hour and 3 hours, respectively.

Furthermore, Company J can sell only 45 units of A-1 and 100 units of A-2. However,

Company J is considering expanding Operation 1's capacity by 90 machine hours at a cost of US $80 per hour. Assuming that Operation 2 has sufficient capacity to handle any additional output from Operation 1, how much should Company J produce?

- Option A

- Option C

- Option C

- Option D

Answer(s): C

Explanation:

A-1's throughput contribution margin per unit of the scarce resource the internal binding constraint) is US $150 $150 UCM - 1 machining hour). A-2's throughput contribution margin per unit of the scarce resource is U $100 $300 UCM - 3 machine hours).

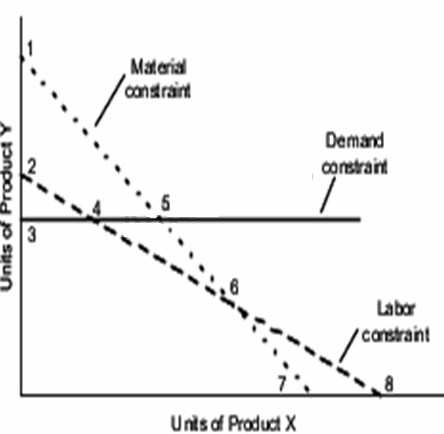

Consequently, Company J should produce as much A-1 as it can sell 45 units). If Company adds 90 machine hours to increase the capacity of Operation -I to 270 hours 180 + 90), it cannot produce additional units of A-1 because the external binding constraint has not been relaxed. However, it can produce additional units of A-2. Given that the UCM per machine hour of A-2 is U $100 and that the cost is US $80 per hour, adding capacity to Operation 1 is profitable. Thus, Company J should use 45 machine hours to produce 45 units of A-1. The remaining 225 machine hours 270 - 45) should be used to produce 75 units 225 - 3 hours) of A-2. The latter amount is within the external binding constraint. A company produces two products, and Y, which use material and labor as inputs. Fixed amounts of labor and material are available for production each month In addition. the demand for product Y each month is limited: product has no constraint an the number of units that can be sold. A graphical depiction of these production and demand constraints is presented in the opposite column.