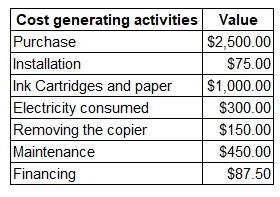

When devising a business case for purchasing a new copier, Maria analyses its whole-life costs as following:

Though cost generating activities are identified, she has not categorised the costs.

What is the total value of copier's end of life costs?

Answer(s): C

Explanation:

Life cycle costing is a key asset management tool that takes into account the whole of life implications of planning, acquiring, operating, maintaining and disposing of an asset. The process is an evaluation method that considers all ownership and management costs. These include;

- Concept and definition;

- Design and development;

- Manufacturing and installation;

- Maintenance;

- Support services; and

- Retirement, remediation and disposal costs.

End of life costs often comprise of decommissioning, removing and disposal costs. In the copier scenario, the end of life costs equal to removal cost, which is $150.

Reference:

- Life Cycle Cost Guidelines (dlgsc.wa.gov.au)

- CIPS study guide page 36-40

LO 1, AC 1.2