HOTSPOT

A company uses Dynamics 365 Business Central. There are three departments (ADM, PROD and SALES) that are set up as dimensions.

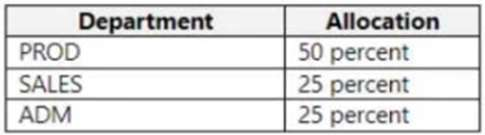

A customer wants to speed up the purchase invoice entry process for building materials by having the AP clerks fill purchase invoices without using dimensions. Monthly building expenses can vary between $5,000-$7,000 per month. The allocation of building expenses is as follows:

Allocation of the monthly building expense between dimensions is required at the end of each month.

You need to configure the system to automatically allocate building expense total balances each month between dimensions.

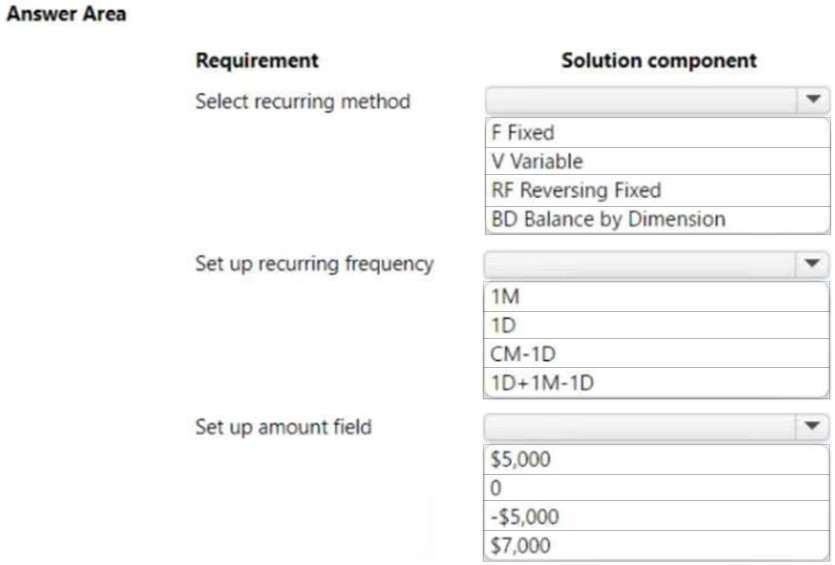

How should you configure recurring general journals? To answer, select the appropriate options in the answer area.

Note: Each correct selection is worth one point.

Hot Area:

- See Explanation section for answer.

Answer(s): A

Explanation:

Box 1: BD Balance by Dimension

Recurring Methods

The Recurring Method field determines how the amount on the journal line is treated after posting. There are eight recurring methods that can be selected from in Business Central.

BD Balance by Dimension

The balance of the account by dimension is allocated among the accounts and dimensions specified for the line on the Allocation page. Similar to the Balance method but the dimensions can also be specified, with a prompt to set the dimension filters when this option is selected.

Note: B Balance

The balance of the account on the line is allocated among the accounts and dimensions specified for the line on the Allocation page. For example, the allocation of an expense account across departments.

Incorrect:

* V Variable

Use when the journal amount is different each period. The amount on the journal line is cleared to zero after posting. For example, monthly variable expenses such as salaries and wages.

* F Fixed

Use when the journal amount is the same for each period. The amount in the journal line remains unchanged after posting. For example, monthly fixed expenses such as rent.

* RF Reversing Fixed

The amount of the journal line remains unchanged after posting and a reversing entry posts on the following day. For example, monthly accrual of a fixed amount invoice is not received until the following month.

Box 2: 1D+1M-1D

Allocation of the monthly building expense between dimensions is required at the end of each month.

Recurring Frequency

The posting date recurrence is defined in the Recurring Frequency field. Entering a formula in this field determines how frequently the entry will be posted. For example, if the formula 1M is entered with a posting date of 1/02/22, after the journal is posted the date changes to 1/03/22. To post the journal on the last day of a month, enter the formula 1D+1M-1D (1 day + 1 month -1 day). With this formula Business Central calculates the date correctly regardless of how many days are in the month.

Box 3: -$5,000

A positive amount in the Amount field is debited to the main account and credited to the balancing account. A negative amount is credited to the main account and debited to the balancing account.

Reference:

https://ebs.com.au/blog/recurring-journals-in-business-central