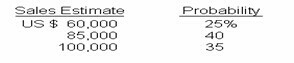

Philip enterprises, distributor of compact disks(CDS),is developing its budgeted cost of goods sold for 1998.Philip has developed the following range of sales estimates and associated probabilities for the year:

Philip's cost of goods sold averages 80% of sales. t hat is the expected value of Philip's 1998 budgeted cost of goods sold?

- US $85,000

- US $84,000

- US $68,000

- US $67,200

Answer(s): D

Explanation:

The expected value is calculated by weighting each sales estimate by the probability of its occurrence. Consequently, the expected value of sales is US $84,000 [$60,000 .25) + $85,000 .40) + $100,000 .35)]. Cost of goods sold is therefore US $67,200 800/0 $84,000).