An international nonprofit organization finances medical research. The majority of its revenue and support comes from fundraising activities, investments, and specific grants from an initial sponsoring corporation. The organization has been in operation over 15 years and has a small internal audit department. The organization has just finished a major fundraising drive that raised US $500 million for the current fiscal period.

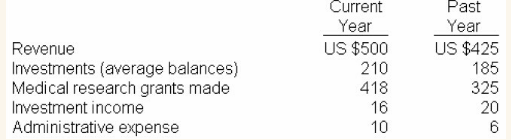

The following are selected data from recent financial statements (US dollar figures in millions):

The auditor wishes to determine if the change in investment income during the current year was due to (a) changes in investment strategy, (b) changes in portfolio mix, or (c) other factors.

Which of the following analytical review procedures should the auditor use?

- Simple linear regression that compares investment income changes over the past 5 years to determine the nature of the changes.

- Ratio analysis that compares changes in the investment portfolio on a monthly basis.

- Trend analysis that compares the changes in investment income as a percentage of total assets and of investment assets over the past 5 years.

- Multiple regression analysis that includes independent variables related to the nature of the investment portfolio and market conditions.

Answer(s): D

Explanation:

Regression analysis develops an equation to explain the behavior of a dependent variable (for example, investment income) in terms of one or more independent variables (for example, market risk and the risks of particular investments). Multiple regression analysis is the best approach because it allows the auditor to regress the change in investment income on more than one independent variable.